Every vision needs a plan, every plan a budget and every budget an estimate of costs. To this end, the assessments and diagnostics phase of an integrated national financing framework (INFF) provides for a detailed understanding of financing gaps for national priorities and the SDGs, and of challenges, risks and opportunities in a country’s financing landscape.

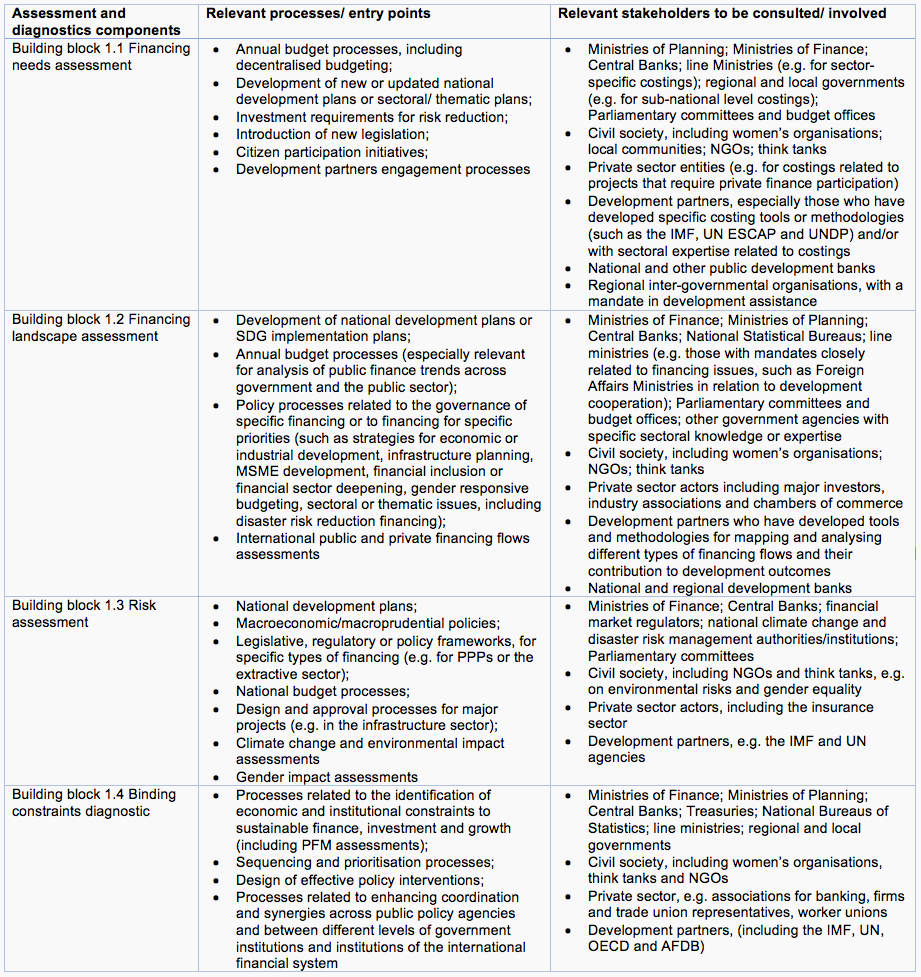

This guidance material on the assessments and diagnostics building block of an INFF consists of five elements:

- this Overview note; and four detailed guidance notes on:

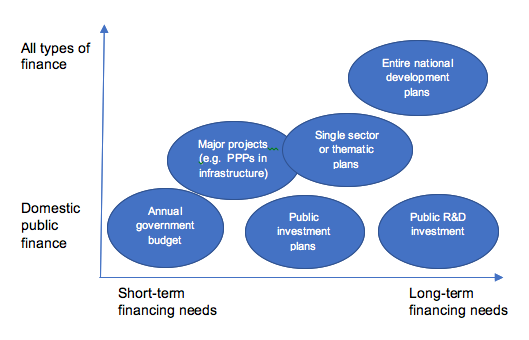

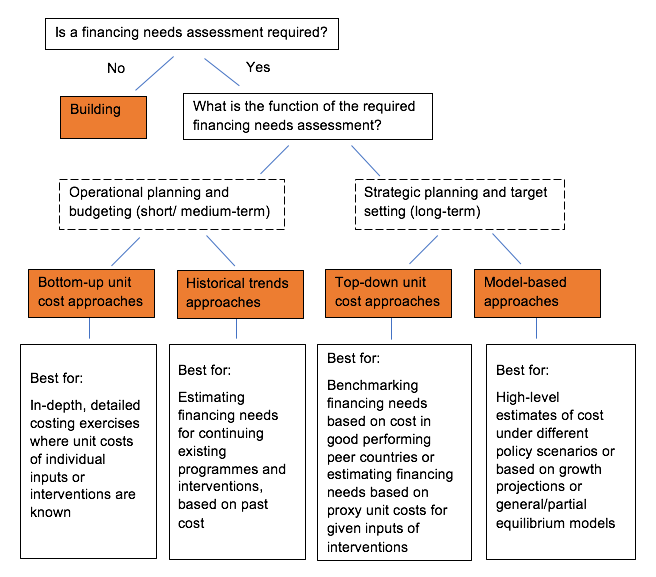

- financing needs assessment (building block 1.1);

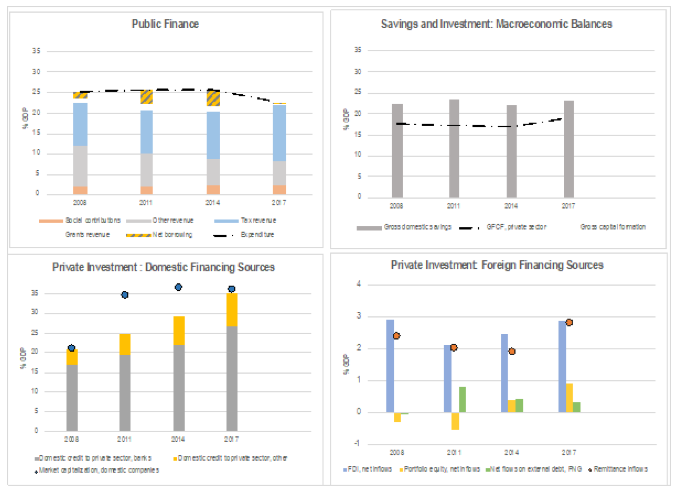

- financing landscape assessment (building block 1.2);

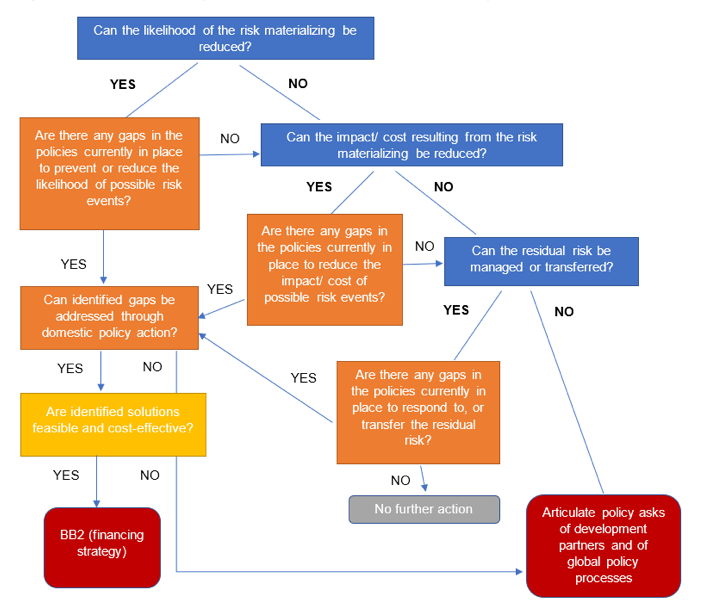

- risk assessment (building block 1.3); and

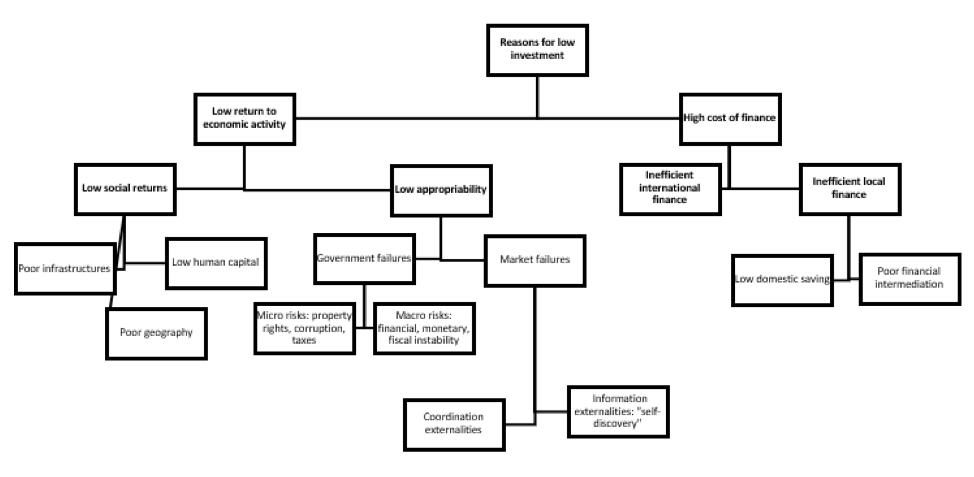

- binding constraints diagnostic (building block 1.4).

It builds on the INFF inception phase guidance, which lays out how countries can initiate an INFF process, institutionalise key oversight structures, undertake scoping and articulate an INFF roadmap. Depending on country preferences and needs, assessments and diagnostics may either be undertaken as part of the INFF inception phase, to inform a more detailed INFF roadmap (facilitated, in many cases, by Development Finance Assessments), or after the inception phase.

The assessment and diagnostics guidance lays out value, scope, lessons learned, and practical ‘how to’ considerations for each of the four main elements. It presents a range of assessment and diagnostics tools and approaches that countries can use to complement ongoing national efforts and provides examples and case studies of how different countries have undertaken such assessments in different contexts.

National and local government officials are the main audience for this material, but it should also be useful for international development partners and other stakeholders supporting governments in their efforts.