The United Nations Development

Programme (UNDP) launched Cambodia’s first development finance assessment (DFA)

report at a virtual event held on 16 July 2021. The event was presided by H.E.

Ros Seilava, Secretary of State, Ministry of Economy and Finance (MEF), and was

attended by 64 participants representing the MEF and other line ministries, UN

agencies, development partners, businesses, research institutes and civil

society organisations.

The publication of Cambodia’s DFA

follows the launch

in April 2021 of the country's integrated national financing framework (INFF) development

process with support from the Joint SDG Fund. The DFA looks specifically at the various financial resources

available to support development in the country – from public budgets, the

international community, private investors and remittances.

The findings, projections and

recommendations of the DFA provide important inputs for the INFF process and the

development of a financing strategy that will inform decision-making for the

allocation and sourcing of funds to reach Cambodia’s Sustainable Development

Goals (SDGs) and national development priorities.

Exploring new ways to fund recovery and get the country back on the

development track

Like most countries, the pandemic triggered setbacks in Cambodia. The economy

contracted by 3.1 per cent in 2020. Losses in financing flows totalled

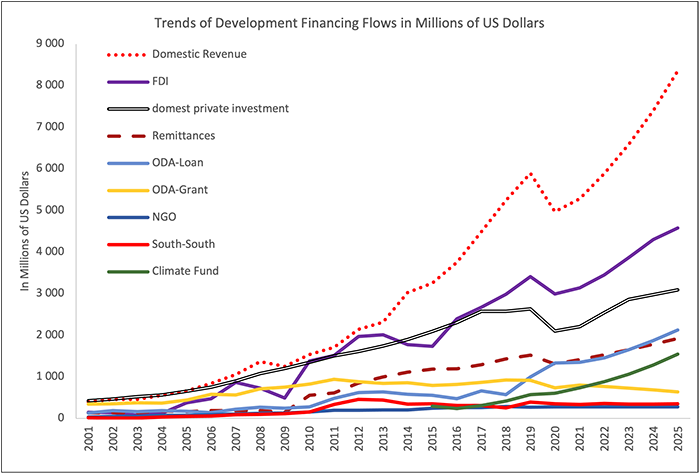

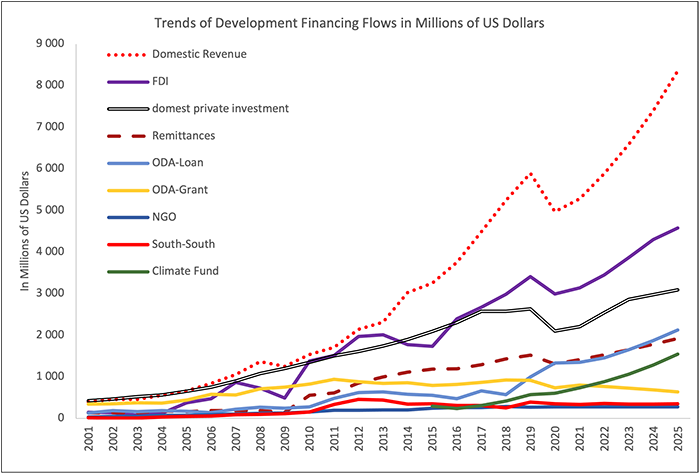

US$3.6 billion in 2020 (Figure 1).

The most severely impacted financial sources were domestic revenue, foreign

direct investment (FDI) and private domestic investment.

Cambodia developed a post-Covid economic recovery plan for 2021-2023 to

chart a path for sustainable and inclusive recovery based on three strategic

directions: economic recovery, reforms and building resilience. To achieve this

ambition, a corresponding investment plan is crucial.

“Going forward, it's very difficult in terms of what to prioritise,” said

H.E. Serey Chea, Assistant Governor and Director-General of Central

Banking at the National Bank of Cambodia. She cautioned that the country is

experiencing considerable pressure on its spending. “If the government has to tackle all these challenges at the same time,

we will need different sources of funding.”

The DFA is therefore timely. "This report is particularly relevant considering

the implementation of economic and social measures by the Royal Government of

Cambodia to respond to Covid-19,“ said H.E. Seilava. The government’s

three-year post-COVID economic recovery plan will be launched soon and is

primarily funded by public resources, but the plan will also explore other possible

financing sources. “I am hoping this report will provide insights on the

different financing options available,” continued H.E. Seilava.

Figure 1: Past and projected financing flows and the impact of Covid-19

Looking beyond LDC

status

Decades of peace, high economic growth and macroeconomy stability created

a strong foundation for the Royal Government of Cambodia to respond effectively

to the crisis. This period of growth has

also set the country on a path to graduate from Least Developed Country (LDC)

status. In 2021, the country met the

minimum threshold for graduation for the first time.

As Cambodia moves towards middle-income country status,

the composition of the country’s financing landscape is expected to shift. Official

development assistance (ODA) in the form of concessional loans or grants will further

decrease. But ODA isn’t the only main financing source available

to support Cambodia’s development.

“Some forms of

finance, such as grant-funded ODA, have fallen dramatically. Other flows, such

as domestic resources, remittances and Foreign Direct Investment (FDI), are

expected to continue increasing,” said the outgoing UNDP Resident Representative Nick Beresford. “Once we are able to ease Covid-19 restrictions, we

can expect a strong growth in development finance flows.”

According to the DFA, financing to support

development is likely to double to US$23.4 billion, accounting for 69.8 per

cent of GDP by 2025. Within those flows, domestic sources and remittances are

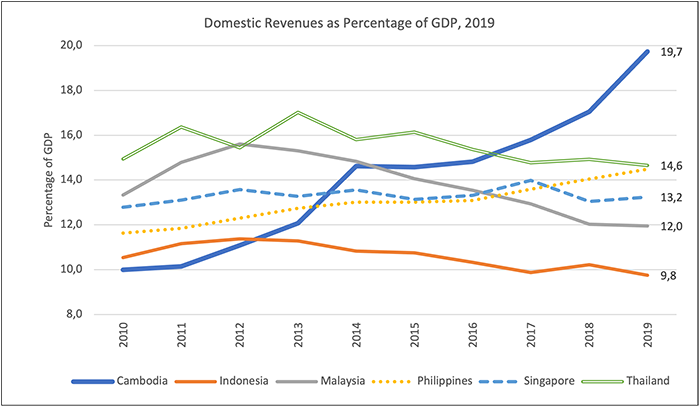

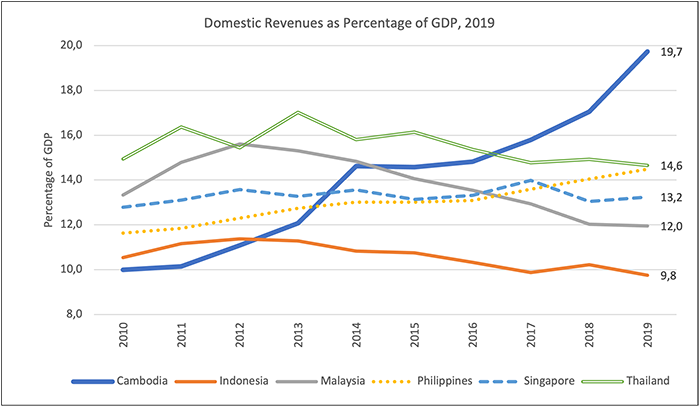

becoming increasingly important. Domestic financing sources, including public

domestic revenue and private domestic investment, have grown quickly over the

past 20 years. Much of this growth has been thanks to significant improvements

in tax collection (Cambodia is the best performer in the region) and the

successful implementation of Cambodia’s resource mobilisation strategy (Figure

2).

While the DFA report presented a positive outlook

for Cambodia’s future financing landscape, there was a strong consensus among

panellists that resting on improvements in tax collection was not enough. Domestic

revenue relies mainly on tax revenue (about 85% of total revenue and 20% of

GDP). Despite improved tax revenue collection in the past,

it is critical to diversify the financing landscape through innovative

financing tools and mechanisms to finance development priorities set out in the

National Strategic Development Plan 2019-2023 and to accelerate the achievement

of Cambodia’s Sustainable Development Goals.

“We should not go back to business as usual,” said Ms Kristin Parco acting as UN Resident Coordinator ad interim, explaining that a

new generation of national development plans will require robust financing

strategies. “This

report makes clear that the time to prepare new sources of financing is now.”

Figure 2: Consistent reforms in tax policy and administration over two decades have yielded positive results. Domestic tax revenue increased from 10.0 per cent of GDP in 2010 to 19.7 per cent in 2019. This makes Cambodia among the best performers in the ASEAN region.

Towards a more holistic

way of thinking about finance

At the launch event, the principal

author Dr Phim Runsinarith, UNDP National Macroeconomic Expert, outlined several recommendations that emerged

from the DFA, building on reforms that the government is already taking forward.

In his presentation, Dr Runsinarith explained that these recommendations represent a more holistic

approach for thinking about financing, looking at the opportunities that exist

across all public and private sources of international and domestic financing.

This holistic lens is a hallmark of the INFF approach.

Recommendations made to increase domestic resource mobilisation include

improving the business environment, strengthening tax collection measures and implementing

sin or public health taxes on the consumption of tobacco and alcohol, and on

activities such as gambling.

Dr Runsinarith also underscored

the importance of issuing domestic lending instruments in Cambodia’s domestic

currency, as opposed to dollar denominations. H.E. Serey Chea outlined the current work being done to develop a national

securities market and the efforts invested by the National Bank of Cambodia to

convince corporations to issue bonds in local currency.

Figure 3: Over 60 participants from government ministries and development partner agencies attended the DFA launch event.

Harnessing the power of the private sector for

development

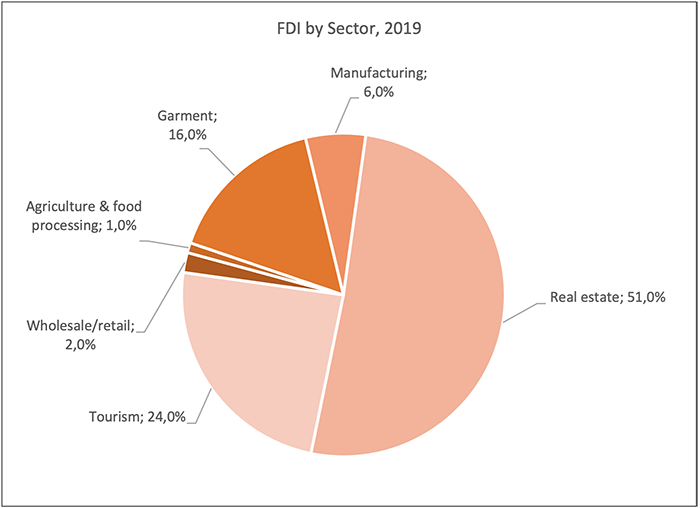

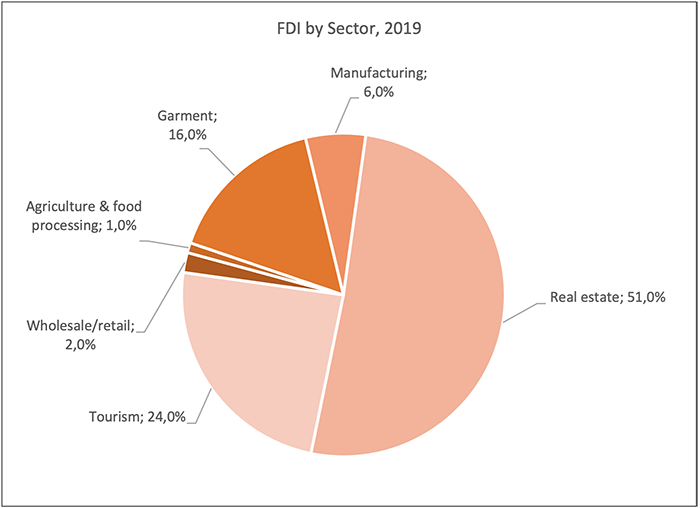

Private

sector investment, which includes both domestic private investment and FDI, has

so far narrowly focused on a few sectors, such as the garment industry, tourism, and

real estate. One of the key themes of the panel discussion was the need to

incentivise private sector investment, particularly, in productive sectors that

contribute towards Cambodia’s national development goals – with particular

emphasis on stimulating the green economy.

The

DFA includes recommendations for boosting the level of FDI and private domestic

investment via credit guarantees to firms and considering the reinvestment of

tax concession. But the panel was in complete agreement – it’s not enough to

restore and maximise private investment, Cambodia must also focus on improving

the FDI quality. There is a need to encourage FDI to diversify beyond

traditional investment spaces into productive sectors that would help the

country achieve its long-term development objectives.

The global financial system is already experiencing

a big shift toward impact and Environmental, Social and Governance (ESG) investment.

According to the Global Impact Investing Network, as of the end of 2019, over

1,720 organizations manage US$715 billion in impact investing assets globally.

A recent OECD report estimates the amount of professionally-managed portfolios that

have integrated elements of ESG assessments exceeds

US$17.5 trillion. The growth of ESG-related traded investment products

available to institutional and retail investors exceeds US$1 trillion. This is

a good indication of the shift in the global financing landscape and

priorities. All panellists agreed that Cambodia must adapt to this changing environment

and seize such sustainable financing opportunities.

Support from the government – and some innovative thinking – is crucial to making this happen.

The DFA report outlines several recommendations that can help steer private

sector investment in new directions.

Public-private

partnerships and blended financing arrangements can draw private sector

financing to under-funded sectors. H.E. Serey Chea underscored the fact

that blended finance is already gaining traction in Cambodia. “As we emerge

from COVID-19, we see the private sector more sustainably minded. But we need

to make sure these funds go towards strategic investments to the benefit of the

country,” said H.E. Serey Chea.

Mr Beresford added that green and

climate change bonds can equally expand financing sources. Issuers would fund projects

that have positive environmental or climate benefits, such as renewable energy

or green and circular economy projects.

Dr Chheang Vannarith, President of the

independent think tank Asian Vision Institute, underscored the importance of

boosting private investors’ confidence in the legal and regulatory system.

“Investors should not doubt our regulatory system and wonder if their

investments are safe.” The panellists noted that Cambodia’s

new investment law, expected to come into force later this year, may be the

catalyst needed to attract investors to new sectors.

Figure 4: FDI investments in Cambodia are mainly concentrated in a few subsectors: garments, tourism, and real estate. In 2019, the construction and real estate sector received the largest share of 51 per cent of total approved FDI.

Next on the agenda: shifting mindsets

In the short run, the DFA provides an analysis of how the socio-economic impacts of the pandemic have shifted the

financing landscape. This can help the Royal Government of Cambodia to deploy

policy responses that account for the varied effects across public and private

finance. Maintaining an understanding of how these trends evolve over time will

be important for an effective policy response as the country navigates the

recovery period and moves forward with the development and implementation of

its national financing strategy. The INFF process is just as much about policy

reforms, incentives, and regulations, as it is about changing the way government

and other national stakeholders think about investing for the future.

Throughout the discussion, the

panellists continued to come back to one question: How can we change the

mindset of Cambodian investors?

“We can talk about sustainable

financing, about green financing. We can have all the rules and evidence in

place, but if people don’t believe in it, then the implementation will not

happen,” said H.E. Serey Chea.

Radhika Lal, UNDP SDG Finance

Policy Advisor, echoed this sentiment, “Once a change in mindset is made,

you’ll start to get investors who are willing to be there for the long-term,

who are willing to diversify.”

Some of the work in shifting

mindsets, developing capacity and sharing knowledge across sectors has already started.

H.E. Serey Chea pointed to the example of the recent memorandum of

understanding between the National Bank of Cambodia, the Association of Banks

in Cambodia, and the Ministry of Environment in this respect. “This has been a

good start in setting the stage for understanding each other’s goals and

working together from there,” said H.E. Serey Chea.

In many ways, the pandemic has opened

the door to new forms of collaboration and new ways of thinking. H.E. Serey Chea has already noticed a change in Cambodia. “What I see standing out during this

period of COVID-19 is a mentality shift. People are more aware of their

surroundings. People are starting to

appreciate the green environment around them.” She hopes that with this mindset shift

– and the right financing framework in place - investments will follow.