On clear nights, the stars shine particularly bright over Cabo Verde. Emanating from a boundless dark canvas, the nocturnal panorama throws in sharp relief the fixed constellations that long served as reference points for navigators that knew and understood their patterns.

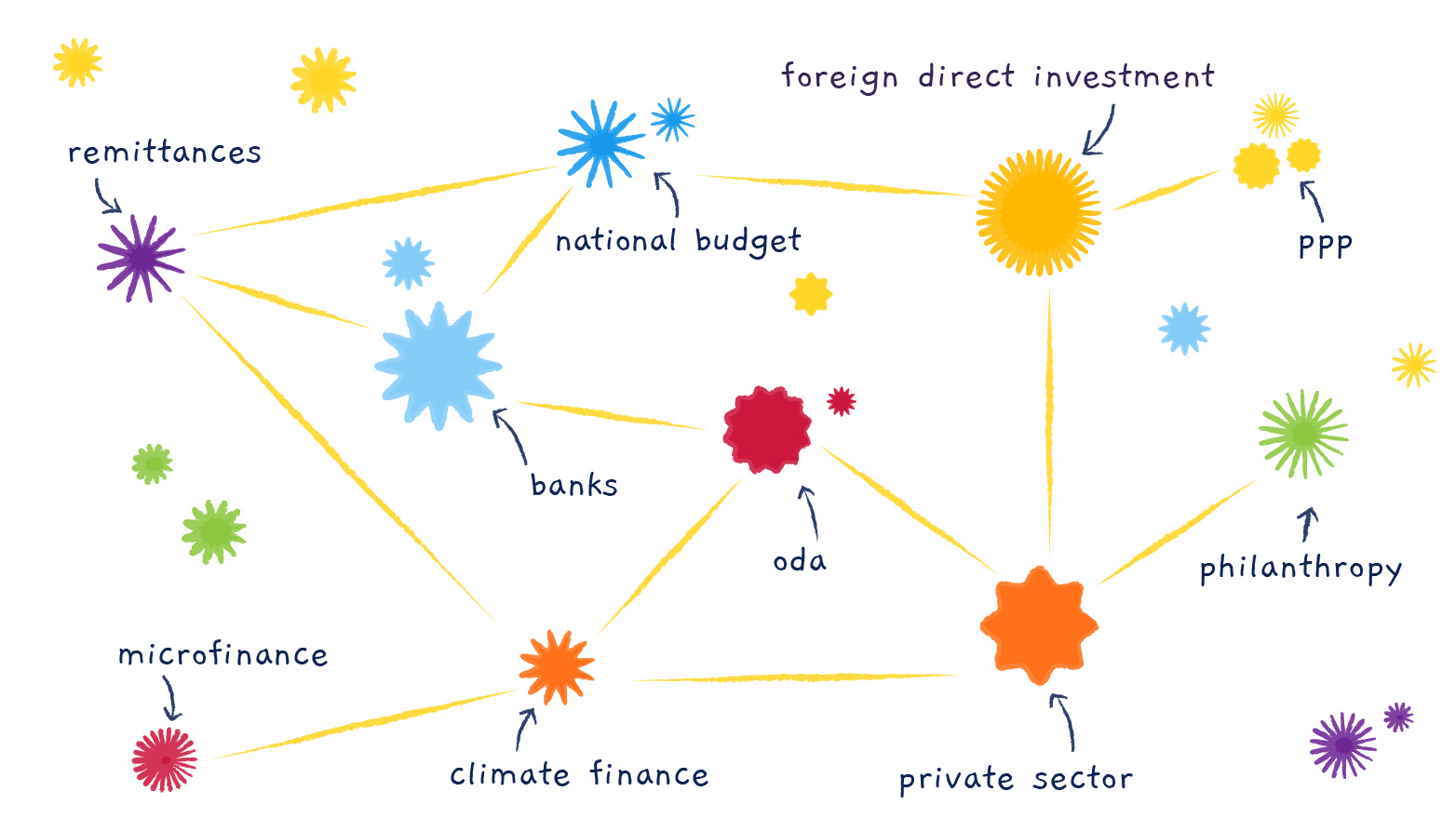

Viewed from a certain vantage, the country’s development financing landscape mirrors these starry constellations. Here, various institutions, policies, and financial mechanisms link together to shape incentive structures and orient human action. Working within this landscape, diverse actors – from government and development partners to businesses, banks, lending organizations, and private citizens – interact, coordinate, and cooperate in countless ways to arrive at decisions on investment and financing that help them achieve their objectives.

When we look at these constellations up close, it’s hard to tell where each point sits in relation to the larger picture. Often, these points remain disconnected or disjointed. Even as they come into contact with others, their experience is limited to their own orbit.

An advantage of developing an integrated national financing framework (INFF) is that it allows all actors involved to zoom out of this picture. A foundational step of an INFF is taking stock of the financing landscape, i.e. putting together a comprehensive picture of the relevant institutions, policies, and structures to better identify the opportunities and barriers to effectively accessing and using public and private resources for sustainable development. In other words, we start the INFF process by first viewing the constellation in its entirety.

When we zoom out, we can see where gaps, duplication and possible synergies exist. We begin to make connections between activities that were previously operating in their own orbits. Forging these connections means governments and supporting partners can leverage progress in one area to inform and boost progress in others.

The more communication, knowledge sharing, and alignment between the different points in this constellation, the better results. This sounds great in theory. But does it work in reality?

In this blog post, we explore an example from Cabo Verde, a small-island developing state off the coast of West Africa with its own set of unique financing challenges. Cabo Verde is an INFF pioneer country, following a commitment by the Ministry of Finance at the UN General Assembly in 2019 alongside leaders from 15 other countries.

In the past, Cabo Verde’s development financing has centred around domestic public resources and official development assistance. But the economic shockwaves of the pandemic have highlighted the vulnerabilities of this model and added urgency to the calls for a shift in strategy. Developed and developing countries alike are searching for innovative strategies to finance recovery and get the Sustainable Development Goals (SDGs) back on track.

For Cabo Verde, the INFF provides an opportunity for the government to systematically rethink its strategy, focusing on harnessing the power and resources of the private sector – especially Cabo Verde’s young entrepreneurs.

“The main conclusion of this pandemic is that we must adapt to the new context in which the world will evolve,” said Dr Olavo Correia, Cabo Verde’s Deputy Prime Minister and Minister of Finance. “The role of young people in this journey will be decisive.”

Supported by the United Nations Development Programme (UNDP) and the Joint SDG Fund, the Government of Cabo Verde began to look across its financing constellation as a whole. The recently completed long-term development agenda, Cabo Verde Ambition 2030, and forthcoming development of the latest iteration of the Strategic Plan for Sustainable Development 2022-2026 (PEDS II) provided the perfect window to embed the INFF approach.

Through the INFF, the government and UNDP began to examine all the different existing and potential instruments available to encourage greater involvement of the private sector in the financing landscape, with a particular focus on five ‘SDG Accelerators’:

- Blue Economy;

- Green Transition and Circular Economy;

- Sustainable Tourism;

- Innovation and Digitalisation; and

- Human Capital.

These investment areas form the backbone of Cabo Verde’s financing strategy, currently under development through the INFF, and align with priority areas for channelling public resources (outlined in PEDS II) and attracting private investment.

Through this process, ideas for two new instruments emerged: the Lavanta Fund and the Negocia Cabo Verde Business Platform.

This is the story of how “zooming out” through the INFF approach helped policymakers integrate two initiatives that, together, empower young entrepreneurs to become SDG accelerators within their local communities.

“New normal” thinking gives rise to innovation

The idea for the Negocia platform was born out of the pandemic. Under a hard lockdown from April to July 2020, any hopes of getting private sector actors in the same room to discuss new opportunities for SDG-aligned investments or collaboration were dashed. Led by organizations like the chambers of commerce (CCISS and CCB), the Association of Young Entrepreneurs of Cabo Verde (AJEC) and the Association of Woman Entrepreneurs of Cabo Verde (AMES), the Cabo Verde private sector quickly adapted by proposing the idea of a digital business platform.

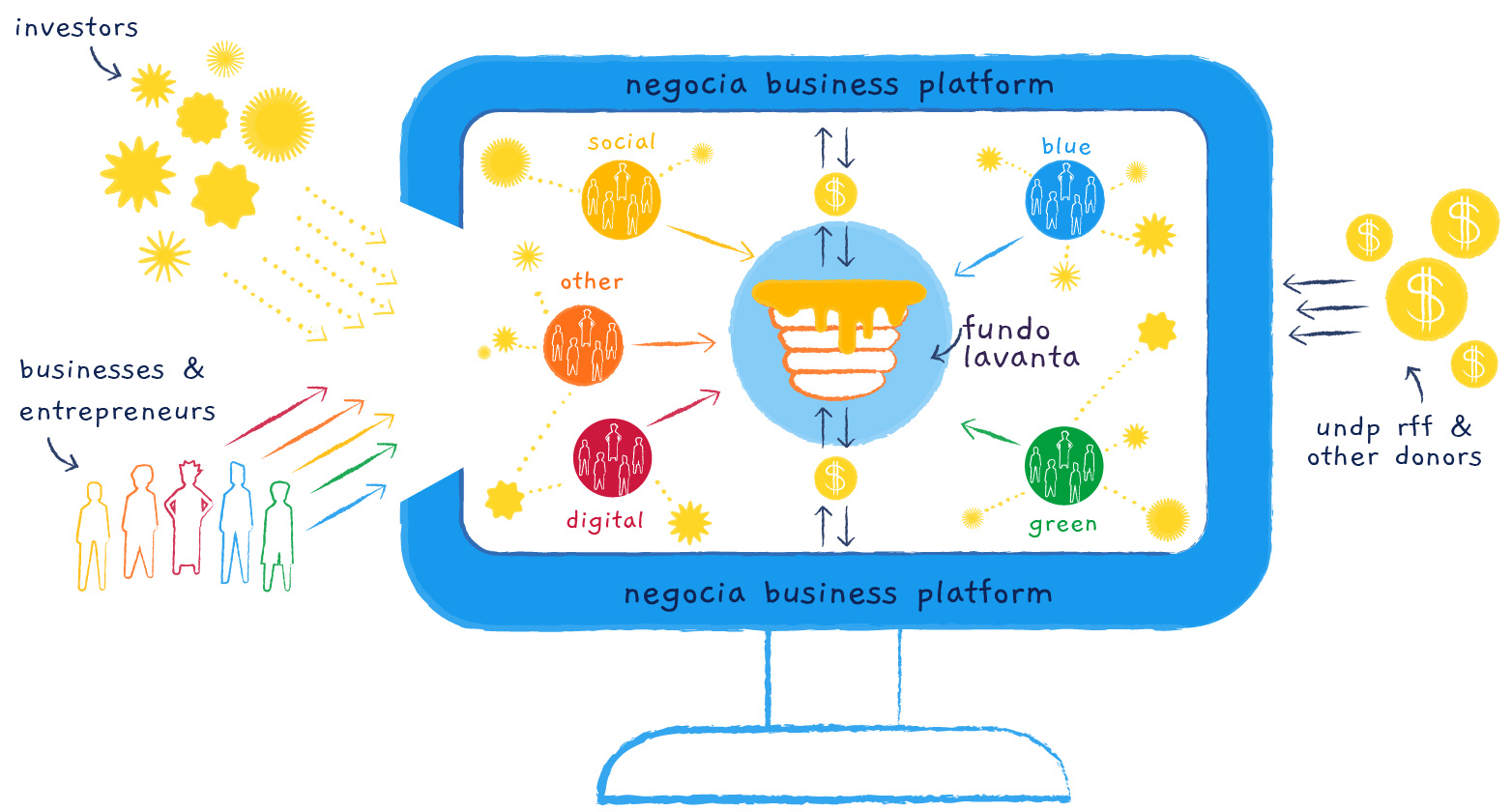

The idea was simple: build a social network-like platform for companies, entrepreneurs, and investors to meet digitally. The platform would connect entrepreneurs with investors looking to finance projects with a positive impact on sustainable development. It would also offer a space for entrepreneurs from across Cabo Verde’s nine inhabited islands to exchange ideas and forge partnerships. Developed by local IT firm BONAKO, under the leadership of the UNDP Accelerator Lab Cabo Verde and with a little financial help from the UNDP Rapid Response Facility (RRF), the Negocia platform was born!

Around the same time, the Ministry of Finance kicked off INFF development, with a particular focus on exploring ways to attract private sector investment and establish a framework conducive to entrepreneurial endeavours aligned with SDG principles.

“Our role is to facilitate and allow our young people to be decisive in the process of growing the middle class in Cape Verde and to take advantage of the potential that these young people have and the contribution they can make to our society,” said Dr Correia.

One of the first steps in an INFF process is to map all the different institutions, structures and actors that form the development finance constellation.

For Cabo Verde (and 60 other countries developing an INFF), this is being done through a development finance assessment (DFA). A DFA helps all actors involved in the INFF process - from government and its international partners to civil society and the private sector - gain a better understanding of the financing landscape.

In Cabo Verde, the current landscape is characterised by a significant cleavage between, on the one hand, the ‘real economy’ comprised of mostly micro, small and medium enterprises (MSMEs) with limited access to investment opportunities and, on the other, the ‘financing ecosystem’ made up of government agencies (those responsible for credit, guarantees, and business development) that work in conjunction with a risk-averse banking system.

Across all INFF experiences, one of the main challenges has been identifying the smaller businesses, investors, and entrepreneurs (and entrepreneurs who may not even know they are entrepreneurs yet) that make up the ‘real economy’. As the DFA illustrates, these small actors make up a large part of the private sector community and represent a large source of untapped potential for development finance.

The question then emerges: How do you identify these different actors in the field and what can the INFF do to support them? Under the umbrella of the INFF, government, together with the UNDP team, realised the best approach would be encouraging self-identification. If small actors identified themselves through a dedicated platform, the government would be able to develop INFF-driven policies and incentives that correspond to their financing needs. The Negocia platform offered the perfect solution.

Through the platform, investors, small businesses and entrepreneurs create online profiles that outline who they are and what they’re interested in: private actors looking for investment opportunities, informal businesses seeking out capital to expand, new entrants wanting to connect with experienced entrepreneurs, etc.

By drawing private sector actors to the platform, Negocia could not only serve as a matchmaking service between small-scale investors and businesses, but also as a database of private sector actors operating within strategic sectors. “It gives all stakeholders – government, investors, partners – a lot of data to work with in terms of who the innovative entrepreneurs are,” said Vladimir Fonseca, Head of Experimentation at the UNDP Accelerator Lab in Cabo Verde. “We would have never been able to identify them without this mechanism.”

Getting the incentives right

If the Negocia platform was going to succeed in getting private sector actors to voluntarily sign up, submit their information and connect with other businesses and investors, there would have to be a draw. But what?

“You have to get the incentives right,” said Elisabeth Goncalves, Innovation and Resource Mobilisation Specialist at UNDP Cabo Verde. “We needed a honeypot to attract users to the platform.”

The team soon found their honeypot in another project being developed under the umbrella of the INFF.

In October 2020, Cabo Verde was awarded funding from the UNDP Covid-19 Rapid Financing Facility to set up a microcredit fund that would provide seed funding to small businesses. “The goal was to stimulate private sector growth in the wake of Covid-19,” said Ms Goncalves.

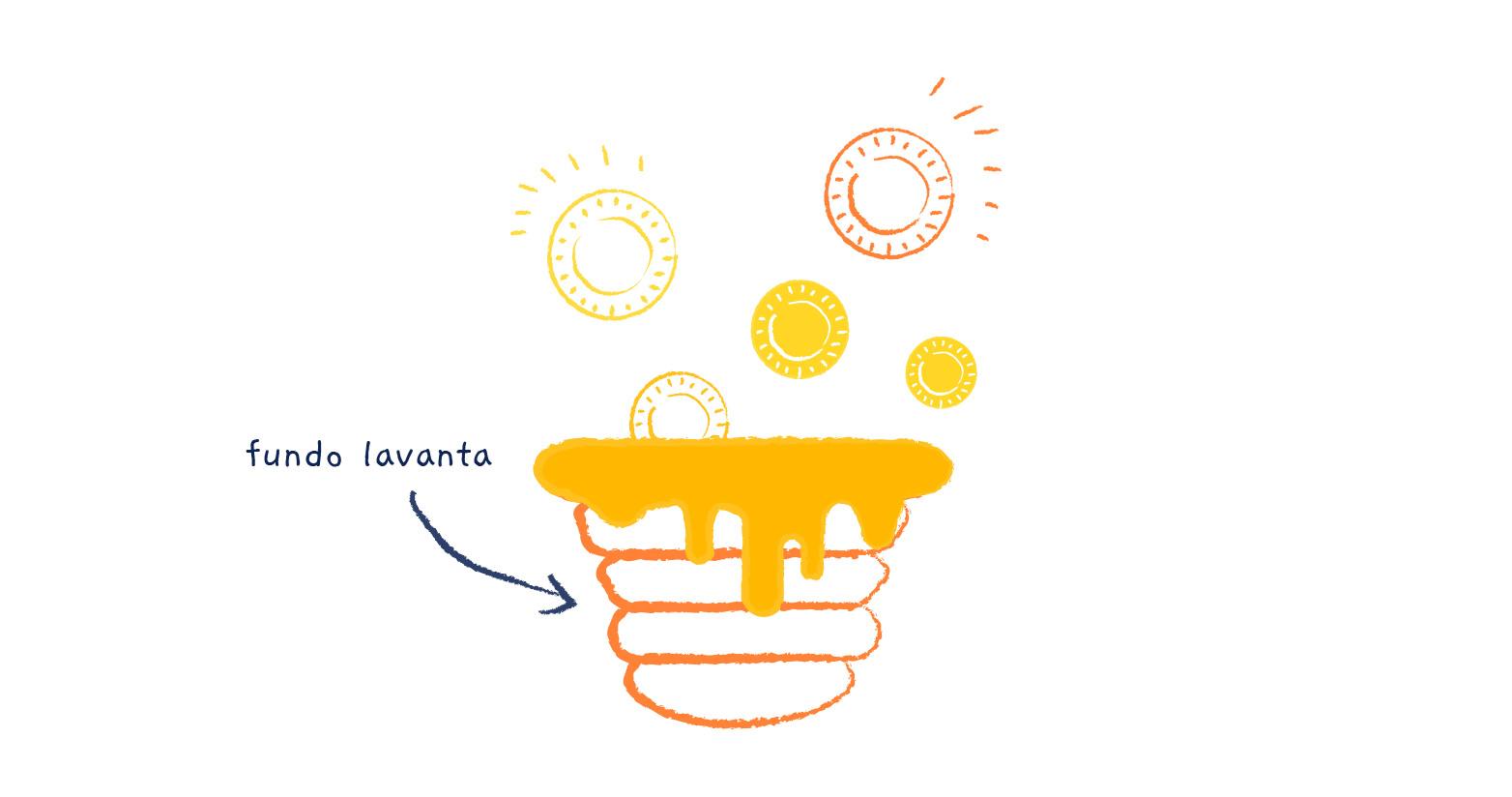

The Fundo Lavanta - lavanta meaning ‘rise up’ in the local Crioulo language - will award loans, ranging from US$1,500 to $15,000, to underrepresented entrepreneurs, primarily young women and men, looking to set up or scale existing businesses that contribute to the strategic development priorities set out in Ambition 2030. By design, the fund advances the mutually reinforcing objectives of socioeconomic recovery, economic diversification beyond the tourism sector, and geographic consolidation of sustainable development across all nine inhabited islands.

Fundo Lavanta is a revolving fund. As the initial borrowers pay back their loans, new loans can be made to other businesses or entrepreneurs who need seed funding. The below-market interest rate covers the administration costs of the fund and capacity-building support for the borrowing entrepreneurs.

Figure 1. From a revolving fund of $300,000 from the UNDP Rapid Financing Facility, Fundo Lavanta awards entrepreneurs US$1,500 to $15,000 in seed funding to start or scale businesses that fall within five categories: green, blue, digital, social and others with inclusive growth and job-creation potential. Once they’ve created a profile on the Negocia platform, entrepreneurs can make connections with other investors looking to support projects that align with the SDGs.

On 23 August 2020 the Cabo Verde Ministry of Finance, together with ProEmpresa, the public institution responsible for managing the fund, launched the Fundo Lavanta on the Negocia platform.

With 60 people in attendance, Dr Correia addressed key stakeholders during the virtual launch: “Covid-19 acted as a brake on our development process. But we are going to be able to make a comeback and the Fundo Lavanta will allow young people to be at the centre of this recovery.”

The launch of the fund was followed by a national media campaign to encourage small businesses across the country to apply for funding. The campaign was picked up by national media outlets, generating broader credibility for the platform.

By using Negocia to administer the fund, the Ministry of Finance created a strong incentive for entrepreneurs with business ideas and start-ups to sign up to the platform. Once they’ve registered, they will gain access to a hub of private sector activity. “We’ve essentially created multiple benefits from a relatively small amount of public funding,” said Steven Ursino, Head of the UNDP, UNICEF and UNFPA Joint Office in Cabo Verde.

As the first round of Lavanta funding comes to a close, entrepreneurs who were not awarded funds can connect with other potential investors on the platform. They can also be considered for future Lavanta funding rounds. “This is not a one-off event that just selects a few winners,” said Mr Ursino. “The platform is a lasting institutional structure that will extend beyond the scope of this one opportunity.”

The honeypot effect

During the three-week Fundo Lavanta application period, the platform reached nearly 2,000 visitors, while registered users grew to over 700.

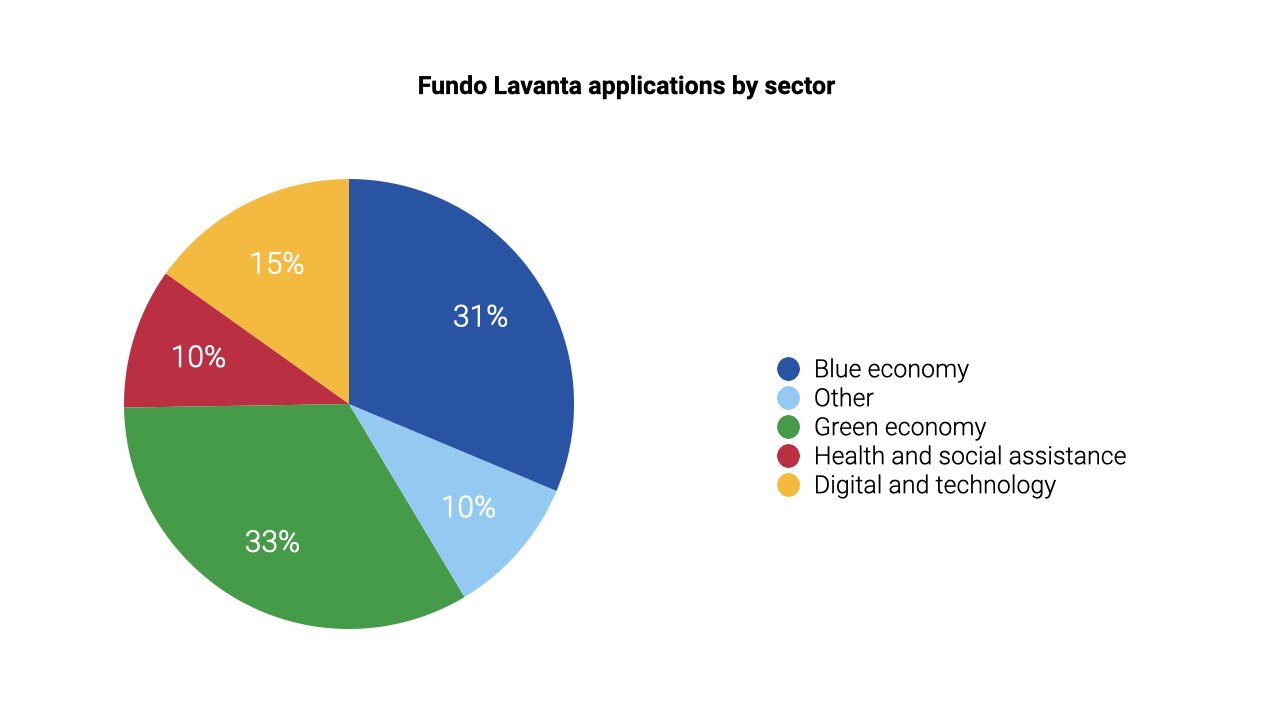

Over 300 entrepreneurs applied for funding across five categories of projects: green (33%), blue (31%), digital (15%), social and health (10%) and other (10%) (Figure 2). Of these, nearly 54% were individual entrepreneurs who have not yet established a company.

Figure 2. Over 300 entrepreneurs applied for funding across five categories of projects.

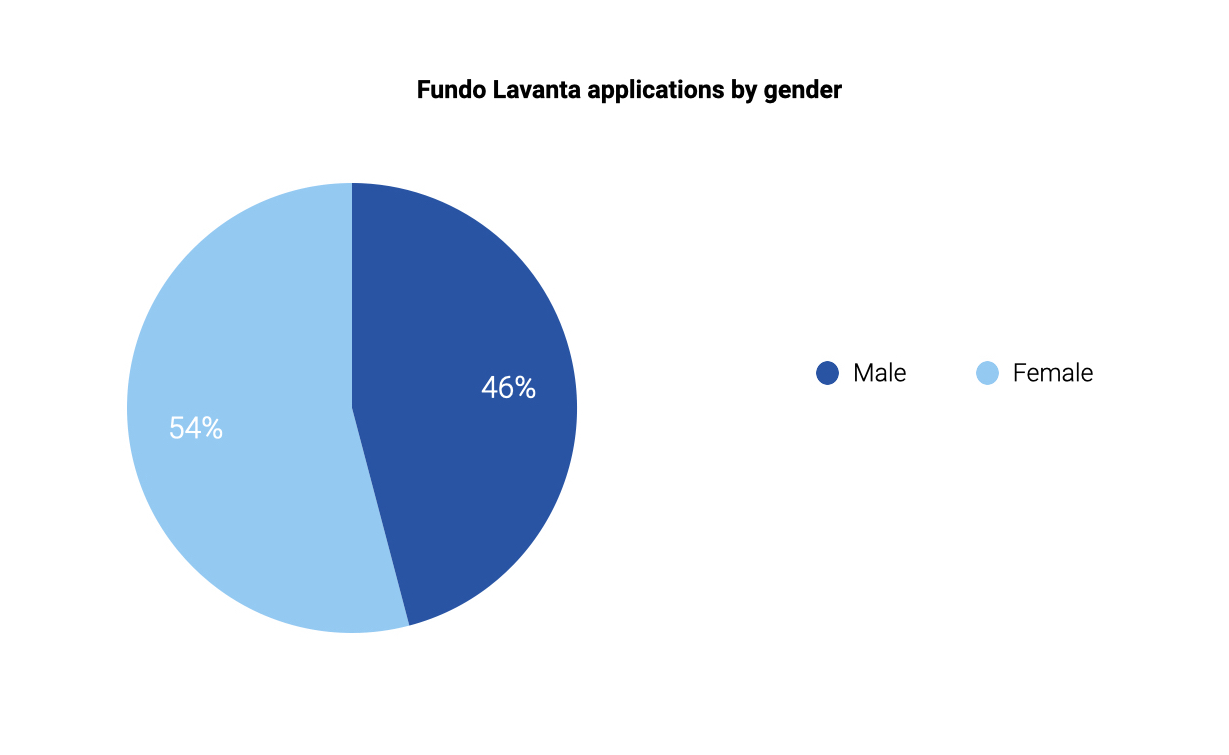

The design of the platform ensures accessibility for a wide range and variety of private actors. Applicants were drawn from each of Cabo Verde’s nine inhabited islands. Over 60% had either vocational training or a secondary school education level. Significantly, 54% of the applicants were women (Figure 3).

Figure 2. More than half of the Fundo Lavanta’s applicants were female.

“These connections would have never happened previously,” Mr Ursino added, “particularly for the youth and women entrepreneurs who have historically been underrepresented in traditional business networking fora.” The beneficiaries will be announced on the 10th of November.

The hope is that the success of this funding round will draw other investors to the platform, essentially creating a digital marketplace for sustainable investment and innovative entrepreneurs. The Ministry of Finance believes the success of the platform has the potential to attract other international donors, Corporate Social Responsibility contributions, impact, ethical or ESG (environment, social and governance) investors and diaspora investors from overseas.

As more private sector actors register and use the platform, Negocia will not only serve as a matchmaking service between investors and businesses, but as a communication and knowledge sharing hub for ethical innovators. “Once we bring people to the platform, we’ll start to see interactions that were previously not possible – between investors and business, and between the public and private sector,” said Mr Fonseca.

In the future, Negocia will focus on facilitating innovation and entrepreneurship from the ground up. “The fund will literally be a corridor for financing major projects that will create jobs, increase the productivity of our young people and support economic recovery,” said Dr Correia. Private citizens will be able to draw on local knowledge, skills, and strengths to build ethical businesses that further the development goals of their community.

Catalysing agents for change

Within Cabo Verde, there is a lingering narrative that the government is responsible for development. However, the INFF process is trying to change this narrative by encouraging everyday citizens to rise up. At the fund’s launch, Dr Correia drove this message home. “The future belongs to you,” he told the next generation of sustainability innovators and aspiring entrepreneurs.

Through initiatives like Negocia and Fundo Lavanta, the government, together with the support of its partners, is promoting decentralised platforms for financing development that will empower citizens to contribute to Cabo Verde’s development story.

This kind of thinking is core to the INFF approach. In many ways, INFFs are about moving beyond traditional narratives of what development financing looks like and making space for more imaginative thinking.

The story from Cabo Verde provides some food for thought: Within our financing constellations, everyday citizens make up millions of tiny little points, but they are often overlooked. How can we use the INFF process to uncover the synergies between these points? How can we forge connections between individuals to accelerate progress?

In each country developing an INFF, there are citizens interested in becoming agents for change within their communities.

The example of Cabo Verde highlights an important lesson: to unlock the SDG financing potential of these everyday citizens, governments need to create inclusive and accessible spaces for private sector engagement, facilitate access to financial resources and tools – and then get the incentives right.

.png)